BTC Nears $42,500 Amid El Salvador Political Developments

Bitcoin experiences a modest retreat to $42,585, impacted by President Nayib Bukele’s win in El Salvador.

BlackRock and Fidelity’s Bitcoin ETFs secure top spots in January inflows, highlighting growing institutional interest.

The introduction of nine new ETFs sequesters significant Bitcoin volume

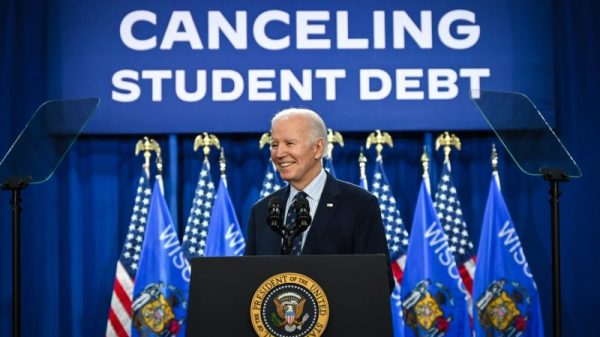

Bitcoin’s recent price adjustment to $42,585 marks a decline of over 1% during the Asian trading session. This change occurs amidst significant political developments. President Nayib Bukele’s electoral win in El Salvador, the first nation to declare Bitcoin as legal tender, has spotlighted the cryptocurrency’s significance in national politics. Bukele’s government, known for its strong stance against gangs and promotion of Bitcoin, might significantly impact the country’s political scene. This raises questions about the potential effects on democratic values and the cryptocurrency market.

$4.8B Boost: BlackRock & Fidelity Lead BTC ETF Frenzy

The escalating interest from institutional investors in Bitcoin is evident. BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin ETF are among the top in January’s inflows. Significantly, they gathered around $4.8 billion collectively. This trend is in stark contrast to the Grayscale BTC Trust (GBTC). The ETF saw substantial outflows, signalling a shift in investor preference towards new Bitcoin investment options. The introduction of nine new ETFs, absorbing 177,949 Bitcoin, highlights a strategic approach to leverage the diminishing availability of the cryptocurrency. Therefore showcasing the market’s changing dynamics.

Bitcoin’s Technical Outlook and Market Sentiment

In light of these events, Bitcoin’s price stabilization above the pivot level of $42,208 indicates a tentative hold in bullish territory. With immediate resistance at $42,819 and additional barriers up to $44,727, the cryptocurrency’s near-term path seems limited, pointing to possible obstacles in maintaining an upward trend. On the flip side, support levels begin at $41,444 and extend down to $39,541. These levels serve as a buffer against significant drops. This indicates a measured optimism among investors as they navigate through current market volatility and geopolitical factors.

This intricate interaction of political events, institutional participation, and market forces reveals the diverse elements influencing Bitcoin’s price movements, emphasizing the cryptocurrency’s vulnerability to worldwide occurrences and shifts in investor mood.

The post BTC Nears $42,500 Amid El Salvador Political Developments appeared first on FinanceBrokerage.